Lead Capture and Routing for Auto Dealerships

Feb 17, 2026

Mahdin M Zahere

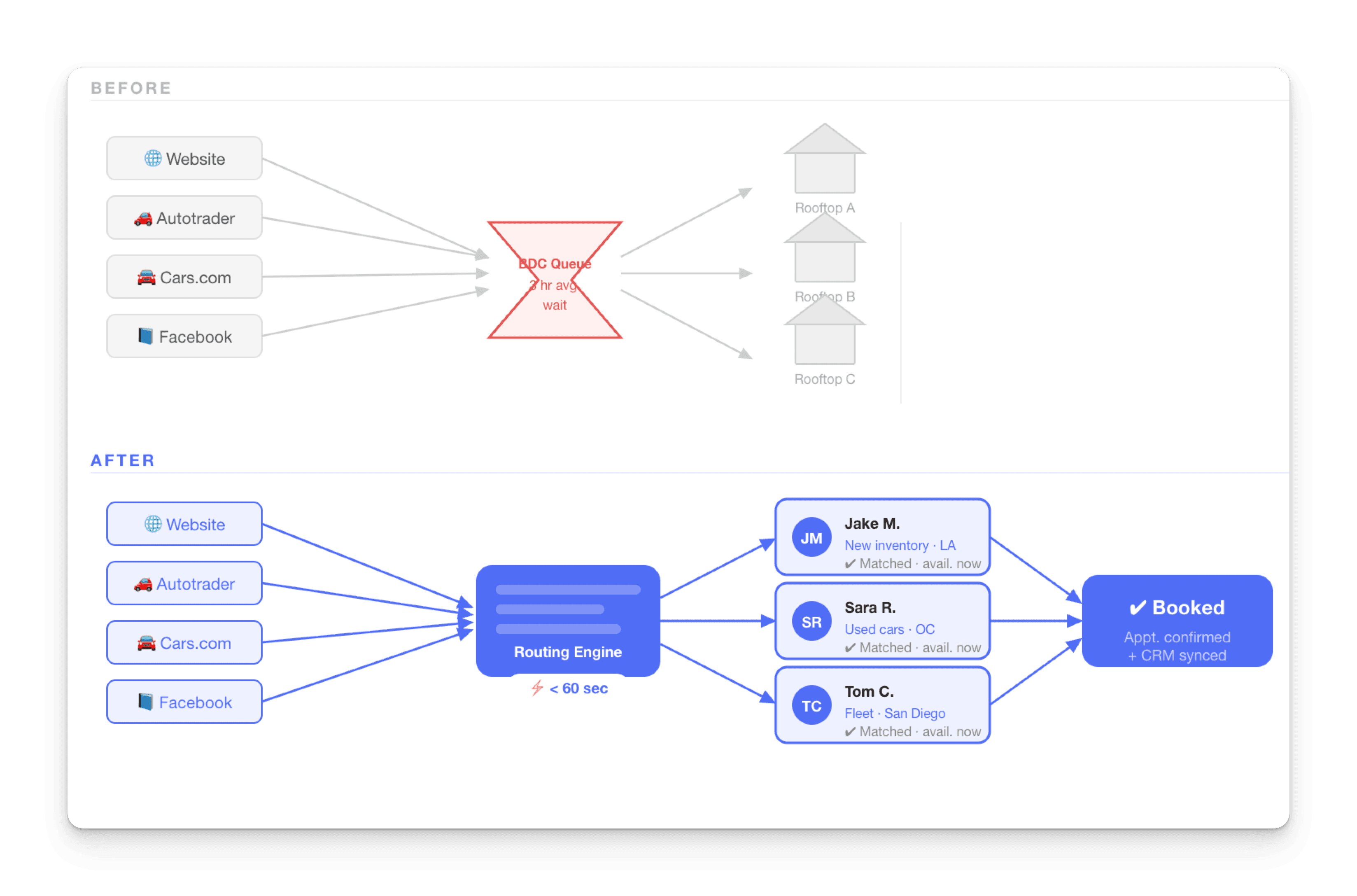

A buyer submits a form on your website for a 2026 Tahoe. That same buyer submits the same form on 2 other dealer sites within 10 minutes. The first dealership to call with something useful to say wins the deal. Your BDC rep sees the lead 3 hours later, calls, and gets voicemail. The buyer already has an appointment somewhere else.

This happens dozens of times a day at most dealer groups. The leads aren't bad. The ads are working. The inventory is there. But the infrastructure between "lead comes in" and "someone useful calls back" is so slow and disjointed that half your ad spend is subsidizing your competitor's sales.

And the problem compounds when you're running 5, 10, or 15 rooftops — each with its own lead sources, its own BDC team, and its own version of "we follow up fast."

The buyer isn't waiting for you

Auto buyers in 2026 are doing 80% of their research online before they ever talk to a human. By the time they submit a form, they've already narrowed to 2–3 dealers. They're not browsing. They're ready to act.

That means the window isn't hours. It's minutes. Data from dealer lead platforms consistently shows that responding within 2 minutes produces 3–5x higher contact rates than responding within 30 minutes. After an hour, the lead is essentially cold — not because the buyer lost interest, but because someone else got there first.

Most dealer groups know this. The problem is that knowing it and having infrastructure that actually delivers sub-2-minute response times across every lead source, every rooftop, and every shift are two very different things.

Where dealer lead ops break

Here's the typical lead flow at a multi-rooftop dealer group — and where it falls apart:

Stage | What happens | What breaks |

|---|---|---|

Lead comes in | Website form, Autotrader, Cars.com, CarGurus, OEM program, Facebook ad | Each source has a different format, different fields, different delivery method — some API, some email parse |

Lead enters CRM | Pushed or imported into dealer CRM (DealerSocket, VinSolutions, Elead) | Minimal context — often just name, phone, and a vague vehicle interest like "interested in SUVs" |

BDC assignment | Round-robin to next available BDC rep | No matching by vehicle type, new vs. used, location proximity, or rep expertise |

Qualification | BDC rep calls and asks basic questions — budget, timeline, trade-in, financing needs | These are questions that could've been answered at capture. 5-minute call for info that takes 30 seconds on a form |

Handoff to sales | BDC rep transfers or sets appointment with floor sales | Context gets lost in the handoff — salesperson re-asks the same questions |

Service leads | Separate intake — often a different phone number, different form, different team | No unified view. A service lead could be a buyer lead in disguise and nobody catches it |

Every stage adds delay. Every handoff loses context. And across multiple rooftops, these problems multiply — different teams running different versions of a broken process.

Round-robin doesn't work at dealerships

Round-robin assignment is the default in every dealer CRM. It's simple. It feels fair. And it ignores everything that matters about matching a lead to the right person.

A buyer asking about a certified pre-owned F-150 should not be routed to a rep who only sells new luxury vehicles at a different rooftop. That's not a training gap — it's a routing failure that wastes the lead's time, the rep's time, and the ad spend that generated the lead.

Smart routing for dealer groups means matching on variables that actually predict conversion:

New vs. used vs. CPO. Different inventory, different sales process, different reps. Route accordingly.

Vehicle type and price tier. A buyer looking at a $28K Camry and a buyer looking at a $75K Escalade need different conversations with different people.

Rooftop proximity. If you have 8 locations, the lead should route to the closest rooftop that has the vehicle they're interested in — not whichever location's BDC team happens to be next in line.

Inventory availability. Don't route a lead for a specific vehicle to a rooftop that doesn't have it in stock. Check inventory in real time and route to where the car actually is.

Rep availability and shift. If it's 7 PM and the BDC team is off, the lead still needs a response. Route to whoever's working — or trigger an automated response that's specific enough to hold the buyer until morning.

Lead source. Third-party leads from Autotrader behave differently than website leads. Some reps close better on one source than another.

This logic isn't exotic. But it requires a system that evaluates these variables at the moment of capture and routes instantly — not a CRM that drops the lead into a queue for a manager to sort through.

What should happen in the first 90 seconds

Here's what a modern lead capture and routing setup looks like for a dealer group:

A buyer submits a form on Cars.com for a 2024 certified pre-owned RAV4. The form captures vehicle interest, zip code, timeline, trade-in status, and financing preference — all in 4 questions.

The system routes in real time. Based on vehicle type (CPO), make (Toyota), buyer zip code, and inventory availability, the lead routes to the closest Toyota rooftop that has CPO RAV4s in stock — and to a rep who handles used and CPO specifically.

The rep gets the lead with full context. Not just "interested in a RAV4." They see: CPO preference, zip code, has a trade-in (2019 Civic), wants financing, timeline is this month. That's enough to have a real conversation on the first call.

The buyer gets a response in under 60 seconds. A personalized text — "Hi David, this is Sarah at [Dealership]. I see you're looking at certified RAV4s. We have 4 in stock right now. I can get you pricing and trade-in value on your Civic — when's a good time to talk?"

That message wins the deal. Not because it's clever, but because it's first, it's specific, and it shows the buyer they won't have to repeat themselves.

BDC time is expensive — stop wasting it on qualification

The average BDC rep spends 40–60% of their call time on basic qualification — budget, timeline, trade-in, financing, vehicle preference. These are questions that could be answered at capture in 30 seconds on a smart form.

When you front-load qualification, two things happen. BDC reps only talk to leads they already know are in-market, have a timeline, and have a vehicle interest that matches your inventory. And the conversation shifts from "tell me about what you're looking for" to "here's what we have that fits — when can you come in?"

That's the difference between a 5-minute qualification call and a 90-second appointment-setting call. Across a BDC team handling 50+ leads a day, that's hours of recovered capacity.

Service leads are buyer leads in disguise

Most dealer groups treat service leads and sales leads as completely separate pipelines. Different forms, different teams, different systems.

But a customer bringing a 2018 vehicle in for its third major repair is a prime candidate for a new purchase conversation. A customer declining a recommended service because the cost exceeds the vehicle's value is telling you they're ready to trade. These signals exist in your service intake data — but if service and sales capture are siloed, nobody connects them.

Unified capture means every lead — sales or service — flows through the same system. Routing rules can flag service leads that match buyer intent signals and route them to sales automatically. Not to replace the service appointment, but to add a parallel sales touchpoint that most dealers are missing entirely.

The math on wasted lead spend

Here's a rough model for a 6-rooftop dealer group spending $80,000/month across all lead sources:

Metric | Current setup | With smart capture + routing |

|---|---|---|

Monthly lead spend | $80,000 | $80,000 |

Total leads generated | 2,400 | 2,400 |

Avg. response time | 3.2 hours | Under 90 seconds |

Lead-to-appointment rate | 12% | 30% |

Appointments per month | 288 | 720 |

Cost per appointment | $278 | $111 |

Service-to-sales conversions | ~0 (not tracked) | 15–25/month |

Same spend. Same lead volume. The difference is entirely in speed, routing accuracy, and front-loaded qualification. That's $167 per appointment in waste — across 2,400 leads a month.

What this doesn't replace

Your dealer CRM stays. DealerSocket, VinSolutions, Elead, CDK — they're built for inventory, desking, and deal management. That's their job and they do it fine.

What they weren't built for is the first 90 seconds — real-time capture, instant qualification, smart routing across rooftops, and sub-minute response. That's a different layer. It sits in front of your CRM, not instead of it.

Where Surface fits

Surface was built for that layer. One system that handles capture, qualification, routing, and instant response — across every rooftop, every lead source, and every department.

For dealer groups, that means forms that qualify before the BDC ever picks up the phone, routing that matches leads to the right rooftop and rep based on real variables, and response times that beat every other dealer the buyer contacted.

If your group is spending six figures a month on leads and your BDC team is still getting name-and-phone-number alerts hours after submission, the fix isn't more leads. It's better infrastructure for the leads you already have. That's what Surface was built to do.